On July 30, President Donald Trump recommended delaying the national presidential election due to the COVID-19 pandemic until citizens would be able to vote “properly, securely, and safely.” Senate Majority Leader Mitch McConnell quickly confirmed that the election will occur on November 3 and that the power to delay elections is a legislative power.

Given the current pollical climate and severity of the COVID-19 pandemic, November 3, 2020 will not proceed as smoothly as it did in 2016 or 2012. What follows is my analysis of the challenges, threats, and opportunities of the 2020 presidential election.

What would happen if Congress delays the election?

If Congress were to delay the election far enough that the results could not be certified by January 6, the Presidency (and Vice Presidency) will still end on January 20. This date cannot be changed, as it would require a Constitutional amendment. If the election has not been certified by the 6th, a few others may be eligible to step in as interim (including Nancy Pelosi).

If the election were delayed a few days, but all necessary parties are able to certify the results by January 6, then a delay may become feasible. Provided, that the United States has a president ready to take over on January 20, any election delay will not disrupt the political system.

What about a universal mail-in ballot option?

34 states already allow absentee voting without providing a reason and there is bipartisan support for an expansion of absentee voting nationwide due to COVID. Practically, absentee voting without excuse (or using COVID as an excuse) is the same as a universal option for mail-in voting. Some states plan to go farther by proactively sending mail-in ballots to all registered voters.

Critics contend that voting-by-mail is more susceptible to voting fraud. There is little reason to believe mail-in votes are more likely to be fraudulent. By example, the Heritage Foundation found only 14 cases of attempted mail fraud out of roughly 15.5 million ballots cast in Oregon since that state started conducting elections by mail in 1998.

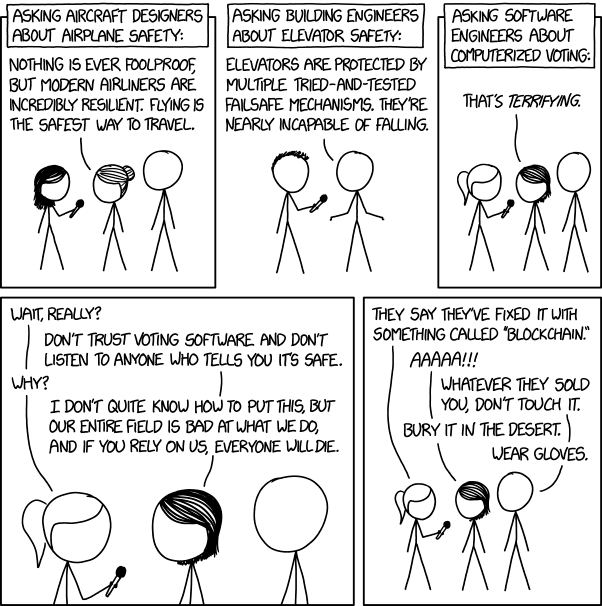

Why not conduct voting online?

This is not a good idea. I cannot stress this enough. Unlike voting by mail, online voting loses the physical record and is rife with cybersecurity concerns. Because I don’t have credibility on the software development process, I’ll leave this one to the experts:

Is normal, in-person voting possible?

Absolutely. Many Americans will vote in person this November. However, voting “normally” might not be as easy as it has been in past elections. In April, the state of Wisconsin ran state elections during the COVID pandemic. Milwaukee, which normally hosts 180 polling locations, had only five open during the election. Polling locations were limited due to a limited number of available workers and locations suited to social distancing. As a result, voter turnout depressed.

So what do I think should happen?

The President’s term will end January 20. That date will not, and should not, change. Congress must certify the results of the election on January 6, I would not change that date either to account for any legal or procedural challenges to the results. Congress should extend the voting window past November 3 for remote voting with a law that supersedes state election laws. States should be given the mandate to keep voting booths open from 8am-8pm minimum, and not close until all who arrived had the chance to vote in a socially-distanced atmosphere (even if that requires keeping polling locations open into the 4th). Additionally, polling locations should reserve a portion of booths for appointment-only voting for those who are in high-risk populations for COVID-19. Those that make it to a pooling location but are unable to vote at the time due to COVID fears or a need to leave before a location is ready, should be given a ballot that can be sent by mail until the 5th.

All states should be required to provide a universal mail-in ballot option. If absentee voting receives bi-partisan support, voting by mail should as well. I doubt that 2020 will set a record for high voter turnout as a percentage of the available population; federal and state governments must making voting as easy and safe as possible.

The key to this approach is to retain as much of the physical voting record as possible. The obvious risk to allowing a longer window for mail-in and in-person voting is that polling stations will receive duplicate ballots. The Federal Government should allocate the funds and resources necessary to allow states to identify and process duplicate ballots correctly. This would be a wise use of funding. States should not be allowed to disclose any results until a pre-determined date when all ballots have been submitted.