For a few days at the end of January 2021, GameStop, a brick-and-mortar video games retailer commanded every news headline. The company’s stock price, valued at $2.57 a share in April 2020, rocketed to a high of $483 a share on January 28, 2021. The company, formally valued around $300 million in market cap, was briefly worth $25 billion. There were no changes in the business that accounted for the change in price.

As of February 12, GameStop is trading at $52.40 a share. More than the paltry $3, but nowhere near its high. The GameStop rollercoaster is over.

Or is it? Although the stock price is beginning to level out, the controversy around GameStop is not yet over. After the stock price jump, and subsequent fall, market insiders and retail investors have started asking for additional regulation to protect their interests. The regulatory response battle will be a long one.

What Happened To GameStop’s Stock?

- Michael Burry bought 3 million shares of GameStop stock in 2019 (under $5 a share).

- After purchase, Burry publicly recommended that GameStop buy back a significant portion of their shares (reducing the total number in circulation).

- He further criticized company management for inefficiencies and corporate greed.

- By late 2020, a few other venture capitalists/hedge fund managers took similar positions in GameStop.

- After posting an operating loss of $63 million, GameStop’s stock plunged again.

- Bloomberg and other analysts publicized that the short interest in GameStop was 144% of the total stock float.

- A few notable YouTubers and Redditors recognized an opportunity to buy GameStop stock for two reasons:

- Fundamentally they viewed the business model and company as undervalued.

- Hedge funds shorted the stock and there was opportunity to profit from a “squeeze.”

The second reason requires a little bit of explanation. John Cochrane describes the short selling process clearly in his blog:

Here’s how it works. A has GameStop shares. B, the short seller, borrows those shares from A, and sells them to C. Now both A and C can have long positions in the stock. We have doubled the supply of shares.

via The Grumpy Economist

Alas, this mechanism is imperfect. It only lasts a day. B must be ready to buy back the shares the next day and return them to A.

The shorts have two options, if the price does not fall:

- Close the position– Pay the market value + interest for the stock to buy the underlying shares. Because B has to buy the stock at market value (that did not fall), B owns the shares and the price of the stock increases due to the increased demand.

- Roll the position –B does not need to give the stock back on day 2, instead paying more interest each day to continue borrowing the shares from A.

The short selling of GameStop was so prolific that the shorts (B) borrowed more shares than have been issued. The WallStreetBets Reddit and YouTube communities jumped on the opportunity to buy shares, in the expectation that the shares would have to be bought at higher prices by the short selling entities. These communities have become increasingly large over the last few years, corresponding with the rise of fee-free brokers. Fee-free brokers with applications, such as Robinhood, allow individuals with any sum of money (the average account is less than $5,000 and owned by a 31-year-old) to participate in the stock market. Robinhood has over 13 million users; at the GameStop trading peak, analysts predict that nearly 50% of Robinhood users bought GameStop.

The squeeze started on January 12. On January 12, the stock closed at $19.95 per share. January 13? $31.40. January 25, $76.79. January 26:

January 27 closed at $347.51 per share. By February 2, the stock closed under $100 a share and the principle short sellers had closed their positions.

How did institutions respond?

During the period between January 26 and February 2, the stock was halted or paused a number of times by brokers and the New York Stock Exchange.

Robinhood, and similar broker-apps, restricted trading of GameStop and other highly volatile securities during this time. Users were, at times unable to purchase more shares or options of GameStop. Other application users reported that Robinhood actively sold their shares or options of the company, at low prices. Retail investors, understandably complained and demanded action from Washington:

These brokers were quick to respond that they were forced to halt stocks and restrict ownership based on current regulation or clearinghouse requirements.

The brokerages are telling the truth.

When a Robinhood user buys a stock it actually takes two days for the funds to be exchanged (SEC standard), in the interim, Robinhood must post the colleterial for its users’ purchases. Due to Dodd Frank regulation, clearinghouses must set collateral requirements based on concentration of ownership and volatility of a stock. These brokers are not able to use their clients money to post colleterial (the theory is that these restrictions will prevent brokers from irresponsibly losing investor money when they go bust). Depending on the broker, either the clearinghouse forced a halt trading on GameStop, or the broker no longer had the liquidity required to cover the collateral requirements for trading the stock. As an example, the largest clearing organization (DTCC) reported that the industry-wide collateral requirements jumped from $26 billion to 33.5 billion on January 28.

Large institutional traders did not have the same liquidity concerns and were not halted by their clearinghouse agreements from purchasing the stock, or its derivatives.

So who made money?

The GameStop short squeeze was billed as a David-and-Goliath story of Reddit users taking down hedge funds. That isn’t exactly what happened. Short sellers initially lost around $19 billion, but none shuttered. It’s true that Melvin Capital (the hedge fund with the largest short position) required a bailout of about $3 billion from other funds, but hedge funds as a whole were not defeated by the short squeeze. Who made all of the money from the stock increase?

Not retail, generally. GameStop saw a $20.4 billion gain in market cap. Nine investors, led by Fidelity and BlackRock, totaled a $16 billion return on the GameStop short squeeze. These 9 firms made 75% of the total gain.

The returns were mixed for retail investors. Some early retail investors saw significant gains from their GameStop investment, most bought over $100 per share and received only modest gains or, more frequently, losses. When Robinhood limited its users’ ability to purchase stock or sold shares purchased with unsettled funds, retail investors were prevented from capitalizing on potential money making opportunities.

Will it happen again?

I am not a financial advisor, nor do I give financial advice. I am speculating on the frequency of a similar short scenario; rather than on the performance of any individual stock.

For a short squeeze of this magnitude, institutional players must have interests on both sides. Michael Burry and other investors publicly announced long positions in the company. Short institutional firms announced their interests as well. These types of public battles don’t occur often. Firms that take anti-shorting actions tend to have very low returns, making them unlikely targets for long-term value investors. For all of the publicity Robinhood and WallStreetBets received in the GameStop narrative, they did not have the power to push the GameStop stock alone. As noted above, the firms that cashed in on the run were major hedge funds. Institutional money was required to generate the momentum in the stock price.

Second, the short interest in GameStop was greater than the number of shares in circulation. As of February 12 2021, there are no companies in the S&P 1500 with short interest over 100%. While short squeezes occur with short interest well under 100%, the magnitude will not reach GameStop levels.

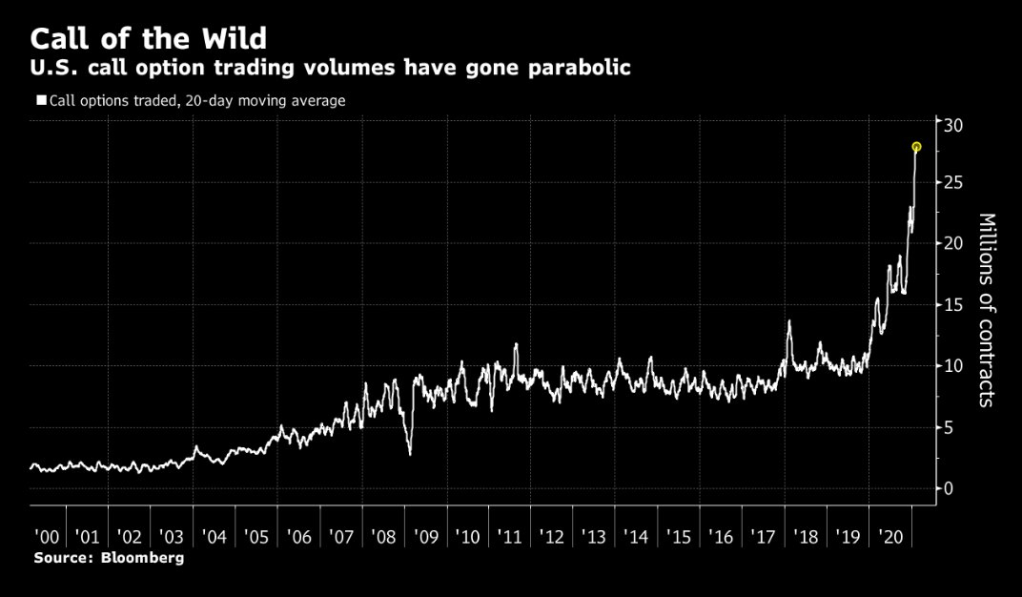

Retail short squeezes might become more common though. Small retail investors will attempt to replicate the GameStop experience on other stocks. Chat rooms, Reddit, and YouTube are not diminishing in size. The WallStreetBets Subreddit (community blog) grew by 2.4 million subscribers during the GameStop short squeeze.

Robinhood continues to grow as well. The tool enables small retail investors to trade stocks, as well as more complex derivatives, without fee. The rise in this app enabled a major rise in speculative investment by individual retail investors (the common folk).

Another GameStop is unlikely, but the increase of speculative investing by small retail accounts will fundamentally change the trading behavior of some stocks. About a year ago, WallStreetBets pushed the stock of Lumber Liquidators through community action. The Lumber Liquidators example is more representative of the market power of the WallStreeBets community. I anticipate more of those stories as the platform grows and barriers to trading are removed through applications such as Robinhood.

If it’s unlikely to happen often, why should I expect regulatory action?

Regulators are receiving pressure from institutions and retail investors to prevent similar situations from happening. On the institutional side, the demand for regulation includes a crackdown on these forums to prevent coordination on certain stock strategies. Institutions calling for greater regulation of social media coordination point to the behavior as a form of market manipulation. GameStop is not the only stock that had a semi-coordinate strategy. The WallStreetBets community tried, to a lesser extent, to exert the same pressure on AMC, Nokia, and BlackBerry.

Retail investors are arguing for regulation that would further democratize the stock market. The nature of these regulations would be to open the number of investment vehicles available for retail investors, to protect trading chat rooms (CNBC is allowed to exist, how is a Reddit forum discussing stocks fundamentally different), prevent clearinghouses from being able to raise collateral requirements in a manner that restricts retail trading.

Although the nature of the regulation that will be introduced is unclear, it’s reasonable to expect a regulatory response. Treasury Secretary Yellen scheduled meetings with the SEC, the Federal Reserve Board, the New York Fed and the Commodities Futures Trading Commission to discuss the recent events in the market. Given the Tweets above, members of Congress are interested in proposing regulation as well. The CEOs of Robinhood and Reddit will testify this month before a House Committee.

Our regulatory system does a lot in the name of “protection” to keep people of low means away from the kinds of investments that wealthy people can access. I think it is likely that the majority of the regulation that comes from the GameStop hearings will attempt to limit “risky” retail behavior, rather than open the market further. I anticipate at least some of the following regulations will be put into place:

- Small-broker applications will be reclassified as gambling applications and regulated in the same manner as sportsbooks (state-level)

- Small-broker applications will need to change their user interface to reduce gamification of stock trading

- Create minimum equity requirements on trading accounts that are able to trade derivatives

- Create a framework for the SEC to hold forums accountable for any coordination on stocks that occurs on the platform

Although the GameStop story received a lot of press, its impact on the stock market and financial institutions of the United States was marginal. Any of the likely regulations above would almost certainly do more harm than was created by the GameStop short squeeze.

I want to know more, what else can I read:

- Epsilon Theory deep dive

- Ordinary Things YouTube Reaction

- Cold Fusion YouTube Analysis

- Twitter thread on collateral requirements

*Addendum–The relationship between broker applications and organization that purchase order flow was not addressed at all in this write-up. The example commonly found in the news is a relationship between Citadel and Robinhood. I intentionally left it out because it is not unique to the GameStop scenario, nor does it related to the underlying activity; however, I see these relationships as an area fertile for proposed regulation.